tesla tax credit 2021 washington state

To qualify for the tax credit EVs must cost below 55000 for sedans hatchbacks and wagons and below 80000 for SUVs trucks and vans. All model 3s were sold as 35000 base price 9000 Long Range Battery accessory 5000 AWD accessory 5000 Performance Package 5000 Premium.

We Take A Look At The New Ev Tax Credit And Which Teslas Qualify

The State of Washington sales tax exemption no longer applies to Tesla.

. As per the provisions of the Inflation Reduction Act the clean fuel rebate will be available on sedans priced up to 55000 as well as vans SUVs and trucks with MSRPs up to. The State of Washington sales tax exemption no longer applies to Tesla. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial.

Tesla Tax Credit Washington State. Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive. You can get a tax credit of 25 for any alternative fuel infrastructure project.

Oregon offer a rebate of 2500 for purchase or lease of new or used Tesla cars. If you cannot find the report online or have questions about an extension contact Taxpayer Account. The way the tax credits work in the Evergreen State will be a little different than the federal tax credit youre used to hearing about.

Initially General Motors Toyota and Tesla models lost their eligibility for the tax credit after recording 200000 sales respectively. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. However the new law has removed that.

Sales tax exemption. The Made in America provision continues the 7500 tax credit for EV purchases through 2026importantly eliminating a cap affecting General Motors ticker. As of July 1 only cars costing less than 35000 qualify for the exemption.

1 2021 - July 31 2023Model. That makes only one of Teslas. Any vehicles purchased after that date are no longer eligible for the Federal credit due to.

In Washington new vehicles are subjected. 1 2019 - July 31 2021. The Annual Tax Performance Report is available to file in my My DOR starting April 1.

Electric Vehicle Incentives As a Washington resident your new or used electric vehicle purchase may be eligible for a range of incentives including rebates and tax credits. Other than tab fee and taxes it would just be the 1200 destinationdocumentation fee that Tesla charges but does not include in the configurator. Up 25000 sales lease price.

A Made In America Ev Tax Credit What Car Buyers Need To Know If Biden Can Advance A Sliced And Diced Build Back Better Bill Marketwatch

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Ev Charging Stations On Highways Dot Approves 50 States Plans

Washington Lawmakers Revive Tax Break For Electric Vehicle Buyers Northwest Public Broadcasting

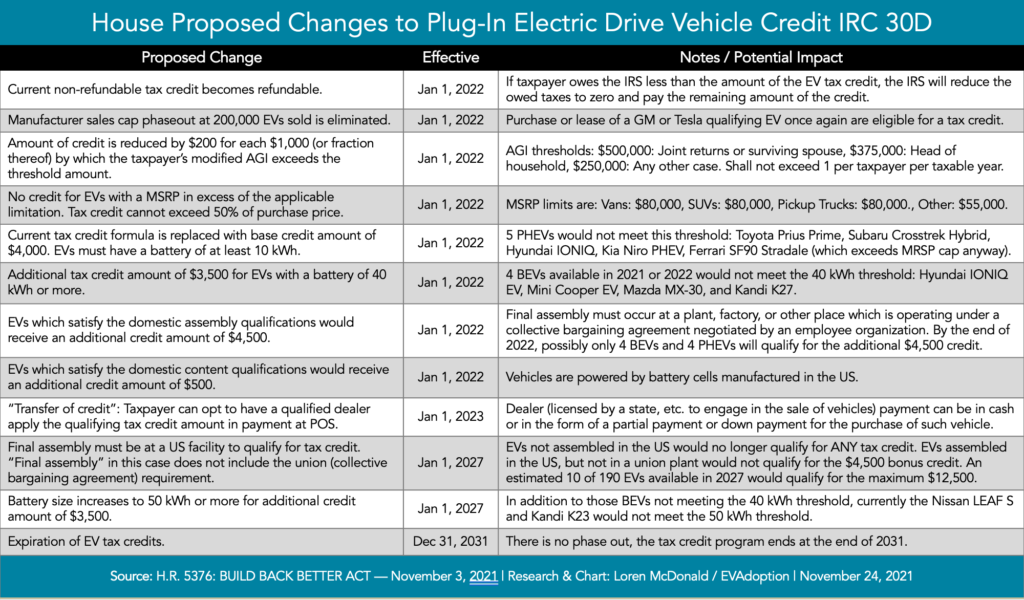

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

What The Ev Tax Credits In The Ira Bill Mean For You The Washington Post

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

Ev Tax Credits Will Be Back For Popular Brands If Law Passes

How Do The Ev Tax Credits In The Inflation Reduction Act Work

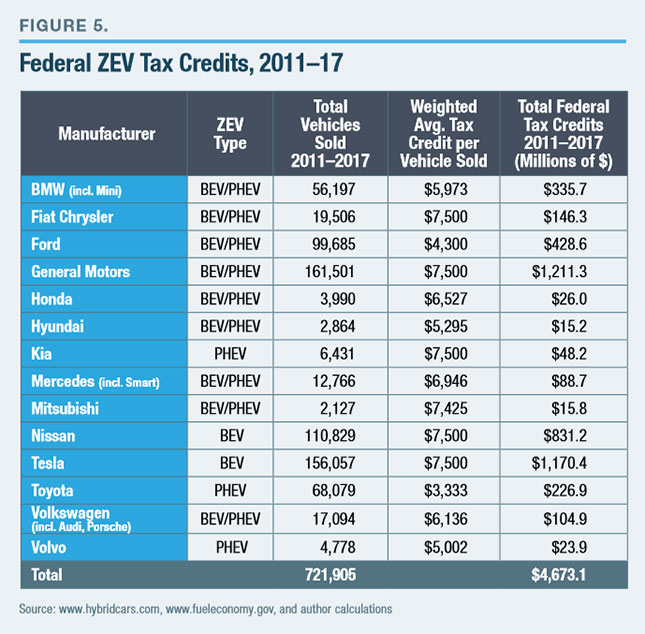

The High Cost Of Electric Vehicle Subsidies Zero Emissions Vehicles

Electric Cars For Everyone Not Unless They Get Cheaper The New York Times

What To Know About Ev Tax Credits In Biden S New Climate Law

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

Real Cost Of 2021 Tesla Model Y In Washington Still Worth It R Teslamodely

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News

Electric Cars For Everyone Not Unless They Get Cheaper The New York Times

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

Washington State Senate Transportation Bill Would More Than Double Electric Vehicle Registration Fees Geekwire